12 Tips for Better Finances in 2023

Considering your cash for 2023? These helpful reminders will get you thinking.

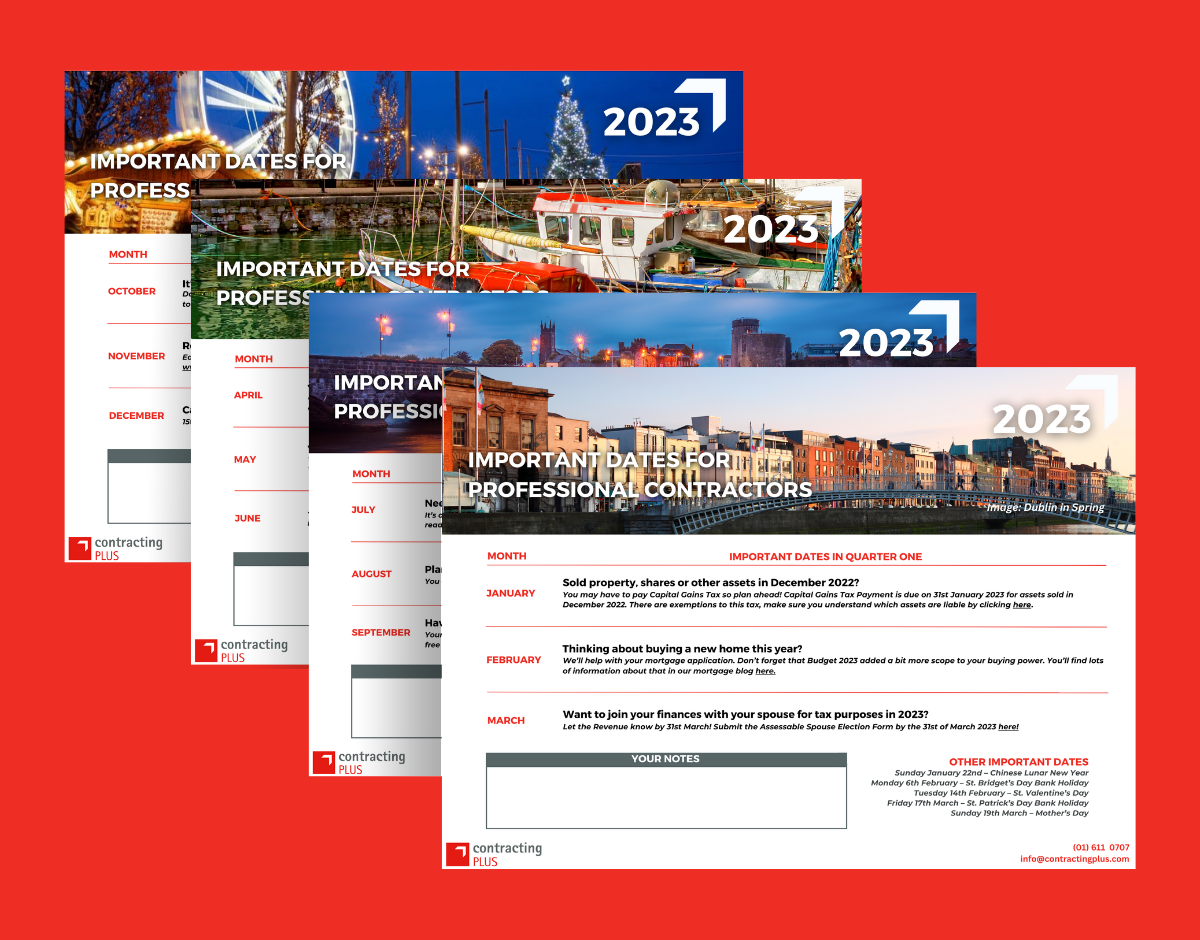

Forewarned is forearmed. We’ve laid out some tips to consider as you progress through the year. Here are our monthly milestones to get you started for a successful 2023. You can also download a handy calendar of reminders here.

January: Sold property, shares, or other assets in December 2022?

You may have to make a Capital Gains Tax payment so plan ahead!

A quick reminder: If you sell an asset for more than you paid for it, you may have to pay tax on the profits! This is called Capital Gains Tax and it’s wise to consider when selling something if you are liable to pay it. If you sell, give as a gift, exchange, or get compensation or insurance for an asset, remember you may have to pay tax on any profit you make. There are exemptions to this tax, particularly concerning spouses and partners and principle private residence, so make sure you understand which assets are liable by clicking here

Have a gain arising between 1 December 2022 and 31 December 2022?

Capital Gains Tax payment is due on 31 January 2023!

February: Thinking about buying a new home this year?

We’ll help with your mortgage application.

If you’re applying for a mortgage, let us know! We’ll help make the application process a little simpler. Contracting PLUS provides its Contractors with a Mortgage Application Pack free of charge. This can contain items such as Statement of Net Liabilities, Income Tax Return & Self-Assessment, Form 11 : Return Summary, Company Report and Financial Statements, Tax Clearance Certificate, 6 Months Business Account History and Contracting PLUS Statement. A quick chat with your Dedicated Account Manager will get the ball rolling.

Remember, Contracting is not a barrier to getting a mortgage. You just have to be organised and prepared during the application process, but we’ll help make that a little simpler too. We can give you details of mortgage brokers who are very familiar with contractor applications. Mortgage brokers can be invaluable partners when dealing with lenders.

Don’t forget that Budget 2023 added a bit more scope to your buying power. You’ll find lots of information about that in our Mortgage blog here.

March: Want to join your finances with your spouse/civil partner for tax purposes in 2023?

Let the Revenue know by 31 March!

Being jointly assessed for tax can be really beneficial. You can transfer most of your tax credits, reliefs and rate band to your spouse or civil partner. Joint assessment can lower your tax bill considerably so if you’re considering it, the deadline to submit the assessable spouse election form is 31st of March 2023. You can complete this step online by logging into the Revenue’s MyAccount site.

If you want to change your joint assessment arrangement to separate assessment or separate treatment for married couples or civil partners, you must also make that change by 31st March. You can learn much more about joint assessment here.

April: If you are a Director or Company Owner in 2022 then Revenue requires you to file a Form 11.

Contracting PLUS’s Tax Return Portal is open!

If you file your taxes early, any refund due will be available earlier than usual!

Don’t forget medical expenses! If you have incurred medical expenses during 2022 and they have not been fully reimbursed under a policy or insurance, you can claim a tax credit of 20% in your 2022 tax return which is due on or before 31 October 2023. This applies to many medical services, including GP services, diagnostic procedures, hospital treatment, physiotherapy, prescription costs and medical appliance costs. Qualifying non-routine dental expenses may also be claimed but requires Form Med 2 to be completed by the dental practice that provided the services. You’ll find lots more information about claimable medical expenses here.

May: You can receive small cash gifts tax free each year: the Small Gift Exemption

If you’d like to make a gift to a loved one or you’re lucky enough to have generous people in your life, it’s useful to consider the Small Gift Exemption at the beginning of the year to make sure you get the maximum relief available in the tax year.

Irish taxpayers can receive gifts of up to €3,000 from any person in a tax year without having to pay Capital Acquisitions Tax.

Each person giving a gift may give a maximum of €3,000 so individuals may receive €6,000 in total from their parents (€3,000 from each) and still be covered by the Small Gift Exemption.

This can be a great way for parents to start paying money into a savings account in their child’s name for the future. For example, if your child is 5 now, and you gift them €250 a month (€3000 a year) by saving regularly, by the time they are 30 there would be a lump sum (ignoring interest) of €75,000. Not a bad start for a deposit on their first home.

This is a very tax-efficient way to gift a family member or friend without them incurring a tax charge. The Revenue explains more here.

June: Thinking about buying a new vehicle in 2023?

Consider a move to a Private Limited Company and save on tax.

Private Limited Company owners can really save on tax when they purchase an electric car through the company. Read more about that here and consider if it’s time to make a move!

https://www.contractingplus.com/how-to-pay-less-tax-using-your-car/

July: Need a tech upgrade this year?

Business computers and mobiles phones are business expenses.

If you need new technology equipment to work, remember that you can claim such expenses against your tax bill. It’s also possible to claim other expenses such as professional subscriptions, business mileage and many more that you can read about in our article. Our Contractor portal allows you to upload your expense receipts as soon as you incur them, and your Dedicated Account Manager will confirm what expenses are eligible if you have any questions.

August: Plan for your Two Small Benefit payments – that’s €1,000 tax free in 2023!

As a contractor, you can purchase one €1000 voucher or two vouchers not to exceed a combined value of €1,000 (e.g. 2 x €500). These vouchers are purchased through your Personal company or Umbrella company and no tax is applied to these. These payments cannot be paid in cash, so consider when you’d like to receive your tax-free voucher or gift card. Are you planning a break away you could use a voucher for? Do you have a celebration you could use a voucher for? Or maybe you’re getting ready for Christmas. Your Dedicated Account Manager will make the arrangements and send you out a voucher when you’re ready. Contracting Plus partners with Me2You making the whole process really simple and supporting an Irish based business.

You can read more about this benefit here. Don’t miss out! Unused benefit amounts cannot be carried over so plan early!

September: Having a good year? Think about adding to your pension!

Get your free annual financial review now.

The maximum State pension you can receive after 66 years (if you’ve worked for more than 48 years) is currently €237.80 per week.

It’s critical to think about pensions at any age now! We strongly encourage you to discuss your pension situation with your Dedicated Account Manager. They will put you in touch with our in-house financial advisors who give all our clients a free financial review – it’s just part of your service. They can help you understand where you can be doing more. Perhaps you can add more voluntary contributions to the State pension or add extra to your private policies. If you’re moving from a PAYE position, our in-house advisors can also review your existing pension policies.

Perhaps it’s time to look at contributing more to your existing pension or moving to a more tax-efficient pension. Did you know contributing to a pension through your company is more tax efficient than as a PAYE worker and the limits on the contributions you can make are significantly higher?

October: It’s tax time!

Income Tax Returns are due by 31 October. Don’t leave it until the last minute to reach out to our Tax Experts with any questions. Our tax portal is the simplest way to prepare.

Capital Acquisitions Tax: If you’ve received a gift or inheritance you may have to pay Capital Acquisitions Tax (CAT). Our tax specialists can help you understand this taxation and you can read more here. If you received a qualifying gift or inheritance with a valuation date between 1 January 2023 and 31 August 2023, you must pay the CAT by 31 October 2023. You can file your return online through MyAccount or Revenue Online Services (ROS) or on paper Form IT38 (Or we can do it for you!). If you received the gift or inheritance with a valuation date between 1 September and 31 December, the tax is not due until 31 October 2024.

November: Review your insurance policies and utility plans.

Maybe you can start saving right now!

When was the last time you priced your insurance policies, or your utility supply rates?

Experts recommend we compare plan costs annually to make sure we’re getting the best deal on all those items we pay monthly by direct debit and then forget about.

You can search some great Irish comparison websites that can help you easily compare health, home and car insurance rates as well as electric, gas and phone providers.

www.bonkers.ie , www.switcher.ie and www.powertoswitch.ie all have accreditation from the Commission for Regulation of Utilities and are a good place to start.

December: Capital Gains Tax Payment

15th of December: Capital Gains Tax Payment for 2023 is due for disposals made 1 January 2023 – November 2023.

Disclaimer: This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only.