Welcome to Ireland!

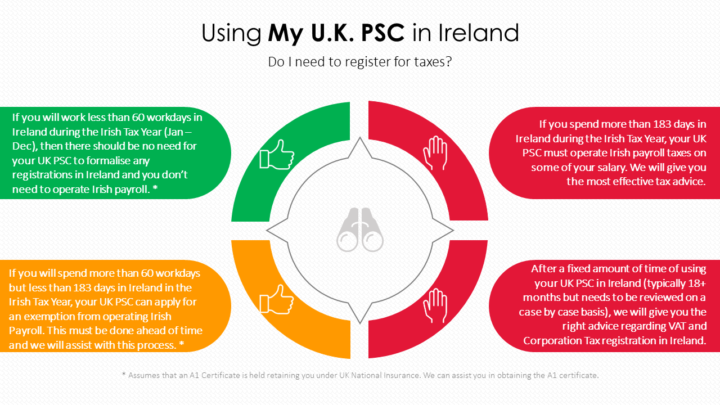

Just a heads up…the tax, payroll and expense rules around Personal Service Companies (UK) and Personal Limited Companies (Ireland) can be quite different. We’ll guide you through the best way to contract in Ireland whether using your UK Personal Service Company or using an Irish Company structure. We ensure you remain compliant while operating in the most tax efficient way.

Should I use my UK company or an Irish Company?

It is generally acceptable to use your UK Company while working on a contract in Ireland. However, if you don’t have your own UK company, or for some other reason you need an Irish company solution, we can set you up as a director in a pre-registered Irish company. There’s no joining or leaving costs, you’re instantly insured and ready to contract in Ireland in less than an hour.

Read about the Irish Director Umbrella solution click here…