Working From Home Expenses

Working from home has never been more popular or as accepted as it is today.

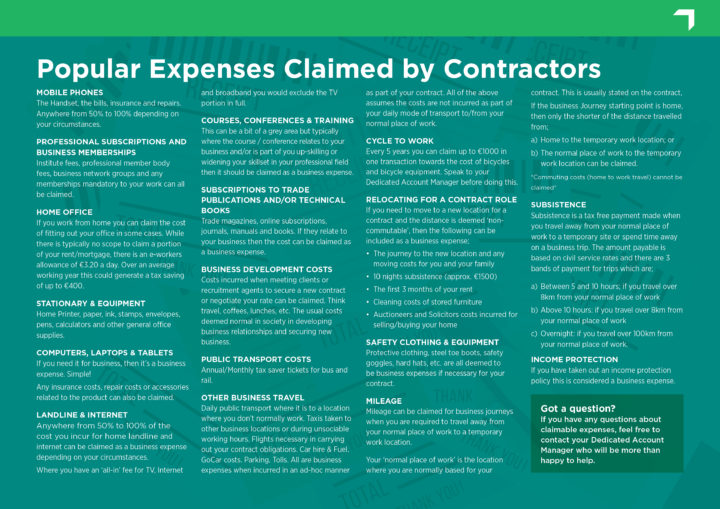

As a Professional Contractor you are entitled to claim a variety of expenses associated with working from home.

Jimmy Sheehan, Managing Director of Contracting PLUS, put together a short video (while working from home) to highlight the more popular expenses you can claim when self-employed and working from home.

Your Dedicated Account Manager will be happy to answer any questions you have regarding your individual situation.