Considerations when purchasing a car through a Limited Company

By Joanne McGrath:

The question whether to purchase a vehicle through your limited company is one that arises frequently. Our Contractors wonder whether it is tax efficient or if it is indeed claimable. The answer is yes to both if you decide to go the Commercial Vehicle or Electric Car route.

Commercial Vehicle

With a Commercial Vehicle, you are looking at vehicle which in general is a 2 door/2-seater vehicle. There may be certain vehicles that are 5 door vehicles which are fine once there are only front seats.

How is it beneficial to you?

The initial outlay to purchase the vehicle and all related expenses will go through your limited company. If the funds are in your Company then you may use these to purchase the vehicle, and the vehicle will become an asset of your Company. However, if you have just set up your Company and haven’t accrued the funds yet but have personal funds to purchase a vehicle, you may loan the funds to the Company to cover the purchase. The Company will then owe the funds to you, tax free.

If you wish to go the Hire Purchase route, all repayments will go directly from the Company Account, and the interest will be recorded as a Company Expense.

As mentioned above, all expenses that relate to the Commercial Vehicle will be Company Expenses. Examples would be Tolls, Repairs, Insurance, Motor Tax etc.

Benefit in kind

With a commercial vehicle there is BIK of 8% of the original market value. This means that whether you purchase a new or 2nd hand vehicle, the BIK is calculated on the value of the vehicle when it was originally produced. The BIK is due for the whole period the Company has the vehicle.

Example

OMV of Vehicle €20,000

BIK of 8% €1,600

You are then liable to tax on the €1,600 over the course of 12 months.

Electric Vehicles

Fully electric cars have no BIK where the new cost of the car was less than €45,000 for 2023. As with commercial vehicles, the BIK is calculated on the original market value of the car. There are changes to the BIK from 2024 onwards.

Example

2024 BIK of 22.5% on values greater than €20,000. So, if your vehicle cost €45,000 brand new, the BIK amount will be €5,625. The tax that will then be paid on the BIK will be approximately €2,925.

2025 BIK of 22.5% on values greater than €10,000. So, if your vehicle cost €45,000 brand new, the BIK amount will be €7,875. The tax that will then be paid on the BIK will be approximately €4,095.

Benefits of Ecars for Customers

€5,000 Government grant towards the purchase of an electric vehicle (See www.seai.ie)

€120 motor tax band for electric vehicles (See www.seai.ie)

Government grant of up to €600 towards home charging point. Please see www.seai.ie for details.

Benefits of Ecars for Businesses

Accelerated Capital Allowance Scheme permitting write off of capital investment within one year once the vehicle cost is less than €50,000. (See www.seai.ie)

Government incentive of €5,000 grant per vehicle and up to €5000 VRT relief (See www.seai.ie)

How to pay for your vehicle

There are a number of different company vehicle options when considering purchasing a vehicle for business use. Here we discuss the more commonly used and, in particular, the effect each method has on your accounts and tax position. These are:

- Buy it outright

- Get it on a Hire-Purchase lease

- Get a business loan to fund it

- Lease the vehicle

Buying it outright

This is paying off the entire cost of the vehicle in one lump sum payment.

Pros

• Once you have bought the vehicle it is yours and therefore it is entirely up to you when, and whether, you choose to sell it.

• There is also no interest to be paid to external parties and therefore you are paying less for the vehicle overall.

Cons

• The main disadvantage to this is the impact it will have on cash flow and it is unlikely that you will recoup a lot of the cost of the vehicle if you did decide to sell it in the future.

How does this affect my accounts/tax?

• The vehicle will be an asset on your balance sheet, but this will reduce over the years by depreciation, which will also reduce your profits. (Commercial Vehicle)

• For taxation purposes, the depreciation will get added back to your profits; however capital allowances can be claimed which will reduce your taxable profits and therefore reduce the amount of tax payable. (Commercial Vehicle)

Hire-Purchase lease

This is where you pay a deposit followed by several monthly payments, and once it has been fully paid off the vehicle becomes yours.

Pros

• Due to the spread of payments your cash flow will allow you a more expensive vehicle then you could have if you were buying it outright. This could also be considered a disadvantage however, if you find yourself acquiring a vehicle that is more expensive than you really need or can afford

• There is an obvious cash flow advantage as the cost is spread over several months.

• The loan is secured on the vehicle itself so it can be easier for you to obtain finance.

Cons

• Interest will be charged, and the rates can be quite high.

• Until the loan is paid off in full, the vehicle cannot be sold without permission from the creditor.

• If you fall behind with payments, the vehicle can be repossessed.

Some providers may charge an “option to purchase” fee at the end of the contract so you must ensure that this is discussed before signing the contract.

How does this affect my accounts/tax?

• In this instance we would class the vehicle as being fully paid off and therefore the usual depreciation/capital allowances (as above) would still apply. (Commercial Vehicle)

• The interest that is being incurred would go to the profit and loss account therefore reducing taxable profits.

• You will still own the vehicle once all the payments have been made and will also have the tax relief on the interest you have incurred.

Get a business loan to fund it

This is where the business gets an unsecured loan and uses it to purchase a vehicle. It is unsecured because it is not attached to the vehicle (like a hire-purchase contract) but to the business itself.

Pros

• The vehicle will belong to the company from the date of purchase and therefore you can choose to modify/sell it as and when you like.

• Any vehicle can be bought with the loan and any cash left over can be spent on other areas of the business

• If the repayments are not met the vehicle is not repossessed in the first instance, although other legal action will follow.

Cons

• As the loan is unsecured, they are usually more expensive, with a higher APR, than a HP agreement.

• If you pay the loan off early, fees may be charged.

How does this affect my accounts/tax?

• The loan is treated as any other with capital payments simply reducing the balance of the loan on the balance sheet in the accounts. The interest paid will go to the profit and loss account and therefore reduce taxable profits. (Commercial Vehicle)

• The car itself will be treated in the same way as buying it outright, i.e. adding it to the balance sheet as an asset. Capital allowances may be claimed on the cost of the vehicle, reducing taxable profits over a number of years. (Commercial Vehicle)

Leasing a vehicle

This is where you pay fixed monthly payments to hire the vehicle.

Pros

• The payments will have a smaller impact on cash flow then if you were to buy the vehicle outright as there would be smaller, regular payments instead of one lump sum.

• Another advantage is that the vehicle maintenance may be covered in the contract, offering you the reassurance of being able to predict and fix what can often be a volatile expense.

• As you are on a contract it will be easier to upgrade your vehicle to newer models which will promote a good company image and ensure the vehicles are reliable.

Cons

• The main disadvantage of this method is that you will never own the vehicle, even after several years of payments and therefore you cannot eventually sell the vehicles and regain some of the cost. This is why monthly payments for a leased vehicle would typically be lower than the payments you would make via the other methods discussed.

• There can be limits to the annual mileage that the vehicle is used for, and if the vehicle is used intensely you must either agree a larger mileage allowance at the outset (which increases the monthly payment) or incur additional mileage charges at the end of the contract (which can be very expensive).

How does this affect my accounts/tax?

• The regular payments made would be included in your profit and loss account and therefore would reduce the profits subject to tax in their entirety.

• If you are VAT registered you can recover 100% of the input VAT that you are charged on each lease payment

Company Cars

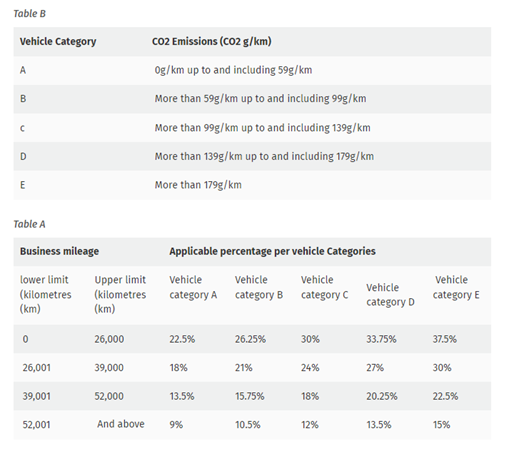

With Company Cars, the BIK is quite high and unless you are doing a large amount of mileage, it isn’t a tax efficient option. Currently, the lowest BIK rate is 9% and to achieve this rate, you would be required to do at least 46,000 business kilometres each year. Below is a list of the BIK rates and the related mileage.

If you have any further queries your Dedicated Account Manager will be happy to help.

Contracting PLUS – Making Contracting Simple

See related articles