Irish Capital Gains Tax Summary

What is Capital Gains Tax?

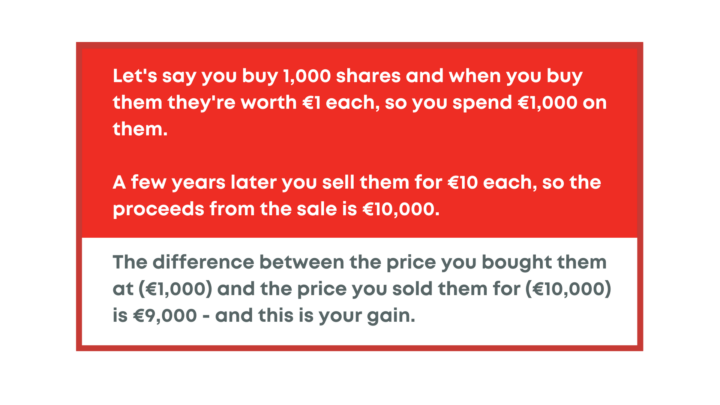

Capital Gains Tax (commonly referred to as CGT) is a tax payable on the gain you make when disposing of an asset.

The gain is liable to Irish CGT if the asset is situated in Ireland, or if you are tax resident or ordinarily tax resident in Ireland (this is based on your days in Ireland in the current and preceding tax year).

The gain is liable to Irish CGT if the asset is situated in Ireland, or if you are tax resident or ordinarily tax resident in Ireland (this is based on your days in Ireland in the current and preceding tax year).

What assets attract Capital Gains Tax?

The most common assets are shares, cryptos, property (but typically not the house you normally live in) and agricultural land.

Many individuals have been granted shares by employers and could be liable to Capital Gains Tax on any uplift in value from the time the shares vest/are exercised and the time they sell. Revenue are actively cracking down on employees not paying the relevant taxes due on Share remuneration. Click here for more information regarding CGT on share disposals.

The tricky thing with CGT is it doesn’t just apply to assets you sell. If you are deemed to dispose of an asset, then you may also have to pay Capital Gains Tax.

Disposing means selling, giving away, transferring to another person or gifting.

But all is not lost! Below, we have covered some exemptions.

How to avoid Capital Gains Tax?

The following gains are all exempt from Capital Gains Tax; lottery wins, betting, animals, government stocks, and personal motor cars.

You’re also exempt from CGT on moveable objects – things like furniture, jewellery and paintings. However, if the person taking ownership of these might reasonably consider them to be an investment – for example, a painting by Picasso, then CGT would most likely apply.

There are also exemptions for certain people.

Transfers of assets between spouses or civil partners are typically exempt. This includes those who are separated, divorced or former civil partners. However, sometimes the relief doesn’t apply so you’re better to give us a call first to double check.

Now to look at the tax itself…

What rate is Capital Gains Tax?

Currently, Capital Gains Tax is 33% of the gain and everyone gets an annual exemption of €1,270. This means you pay no tax on the first €1,270 of capital gains made in a year.

When is Capital Gains Tax Paid?

Unlike other taxes, Capital Gains Tax must be paid before you file your tax return.

If you dispose of an asset between January and November this year, then the tax must be paid by the 15th of December.

The tax due on any assets disposed of in December will need to be paid by 31 January.

When do I file a Tax Return for CGT

Although you pay Capital Gains Tax in the year you make the gain (or January of the following year if the gain was made in December) the actual Tax Return doesn’t need to be filed with the Revenue Commissioners until the following October, and it is at this point that you declare the specific details of the transaction. If you are self-employed, the CGT details can be included on your Income Tax return (Form 11). Alternatively you would complete a Capital Gains Return (Form CG1). If you’re any bit confused, give us a call and we can help sort your tax return.

In some cases, there are additional requirements by Revenue, depending on a property sale price. When selling houses and apartments worth one million euro or more it is vital to obtain a Capital Gains Tax Clearance Certificate (CG50A) from Revenue before closure. Failure to obtain CG50A clearance will mean that the purchaser is required to withhold 15% of the purchase price and pay it to Revenue (a significant sum of €150,000 on a €1 million sale).

You can find further information relating to the CG50A Requirement here

What about Capital losses?

If you dispose of an asset for less than you originally paid for it, then you have a capital loss.

Generally, any loss you make stays with you for your lifetime and it can be used against any capital gains you make at any time in the future.

So, if you have losses, it’s important to register these too, so there’s a record of them.

If you’re still unsure whether or not you need to declare a profit, or loss on the disposal of assets this year, get in touch with one of our tax specialists today on 01 6110707