Everyday medical expenses for you and your family’s GP visits and prescriptions can be claimed. Unusual health and Medical expenses also qualify such as speech and language therapy for a child, gluten-free products for those with coeliac disease and IVF treatment. Dental costs also may qualify for tax relief at 20% where your dentist provides you with a signed Med2 for non-routine work only. You can claim for unreimbursed costs on Crowns, veneers, periodontal, orthodontic, bridgework and removal of impacted wisdom teeth. Unfortunately, you can’t include costs for routine work such as scaling, extraction, filings and the provision and repair of artificial teeth or dentures.

Your dedicated account manager or a member of our tax team will be happy to assist you in identifying the tax relief that your personal circumstances allow for.

To register for myAccount, you will need your:

●Personal Public Service Number (PPSN)

●date of birth

●phone number (mobile or landline)

●email address

●home address.

You can get instant access to myAccount if you can verify your identity with two of the following:

●Irish driving licence number

●information from your P60 for 2017 or 2018

●information about your Income Tax

●notice of assessment or acknowledgement of self-assessment from Revenue.

If you cannot provide this information, please select the ‘by post’ option and Revenue will issue your password by standard post.

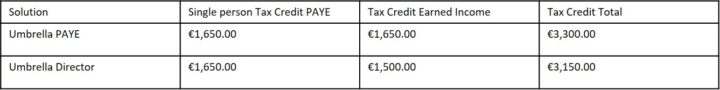

In general, a Single Person should have the following tax credits:

For individuals new to contracting in Ireland, you should obtain a PPS Number as soon as possible to avoid temporary harsh deduction of emergency taxes.

A full list of tax credits can be found on Revenues website here

The income tax return deadline in Ireland is 31st October. You should submit all self–assessment income tax documents by this date. If not, you may be liable to pay penalty fees. Don’t worry your dedicated account manager will remind you when it’s close to the time.

All non-PAYE workers are required to file an income tax return, Contracting Plus have designed a simple tax checklist to help you through the process and once you have it completed we will make your tax return for you, it’s part of our service!

Contracting Plus has a simple tax checklist this will alert us if you have income from other sources, you may need to give us a little extra information and then we can prepare your tax return for you.

While you may have finished contracting, you still need to file a tax return (known as a Form 11) for that year. This is because you were a Proprietary Director of an Irish company at one stage during the tax year. Contracting PLUS have developed a simple online tax checklist which will help you to identify the information that you need in order for us to prepare your tax return for you.

Yes you are entitled to claim tax relief on your pension contributions, simply submit your pension contribution as a business expense every month and Contracting PLUS will ensure you get the relief you’re entitled to.

One of the big benefits of being married is that you get to choose how you are taxed.

• Joint assessment – This means that you will be taxed as one unit and allowed some tax concessions not used by one spouse to be transferred to the other.

• Separate assessment – This is very like joint assessment except that all the available allowances are split evenly between you and your spouse.

• Single assessment – This is where you and your spouse decide to be treated as if you were two single people for tax purposes.

Basically, you can choose to be taxed in the way that will produce the greatest possible tax advantage given your personal circumstances.

Under joint assessment and separate assessment, some unused allowances can be passed between husband and wife. This is particularly beneficial in the case of a two-income couple where one spouse earns more than another.

Under normal circumstances, the Revenue Commissioners will assume that you wish to be taxed under joint assessment, and will calculate your tax liability accordingly.

However, it is worth checking that you are taking full advantage of all the allowances and tax credits open to you, as the Revenue Commissioners may not be fully aware of your financial situation.

The only circumstances under which most people might wish to be taxed under the single assessment system is where they are separated.

If you have any queries about how you would like to be assessed your Dedicated Account Manager will be able to help you.

Generally there is no charge to have your tax return completed by Contracting PLUS, it is part of our service offering. There are some usual cases where fees may be required but these would be discussed with you prior to any work and you can then chose to use the service or not.