Claim your Mortgage Interest Tax Credit

Are you paying through the nose with mortgage interest? You could save up to €1,250 right now!

What is the Mortgage Interest Tax Credit?

A new temporary Mortgage Interest Tax Credit which was recently announced by the Minister for Finance is expected to save homeowners an average of €800.

This one-year credit is for taxpayers who have made mortgage interest payments on their main home, subject to a number of conditions, and it can now be claimed on your tax return.

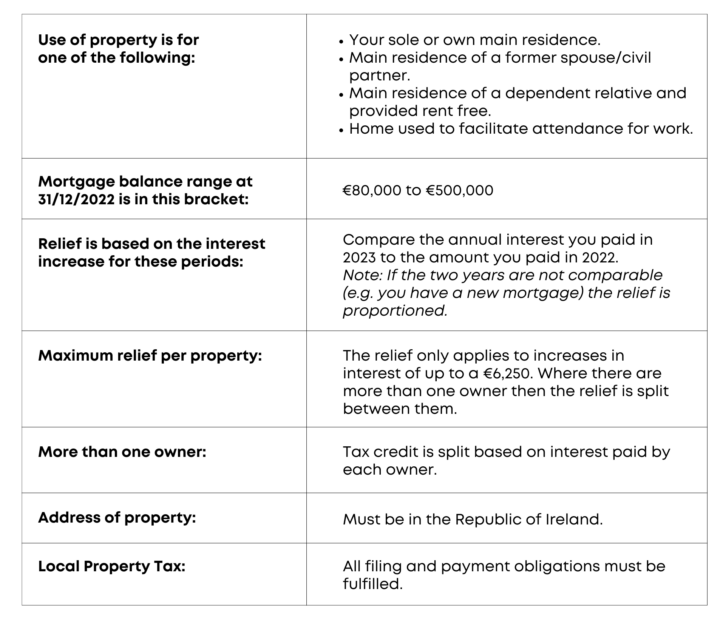

Do I qualify for the Mortgage Interest Tax Credit?

There are some basic criteria that you must meet before you are eligible to claim the Mortgage Interest Tax Credit. To check if you qualify see the conditions set out below.

How to claim the Mortgage Interest Tax Credit?

For PAYE taxpayers you can claim your mortgage interest tax credit by logging into myAccount and select ‘You and your family’ in the ‘Tax Credits & Reliefs’ page. Click on the ‘mortgage interest tax credit’ and work through the claim, then submit your details.

Self-assessed tax payers must file a Form 11 on ROS and the claim for the mortgage interest tax credit can be found in the ‘credits and deductions’ section.

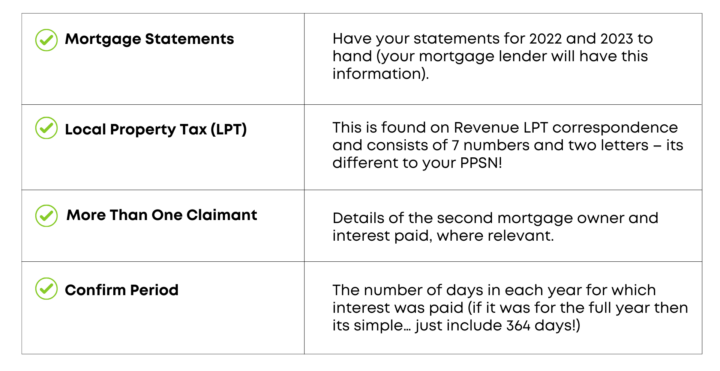

What information do I need to make my Mortgage Interest Tax Credit claim?

To make the claim you need to be able to provide the following information and documents.

Can I claim the Mortgage Interest Tax Credit if my property is in use for other than residence?

Given the conditions outlined above, properties used for commercial purposes would not qualify. It is worth noting that if you are availing of the Rent a Room scheme then your entitlement to mortgage interest relief should not be affected. The Rent a Room relief allows you to earn tax free income up to a threshold of €14,000 however the property must still be considered your main residence.

Remember, tax laws and interpretations can change, so it’s important to get the most current advice based on your specific circumstances. Understanding the system and insightful planning can make that financial difference for you and your family. So when you’re ready to discuss your needs make sure to talk to our team of tax experts or your Dedicated Account Manager. Book a call here.

This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only.

Published February 2024