Capital Acquisitions Tax

By Richard Marshall – Associate Director Tax at Contracting PLUS

Gift and Inheritances

Irish gift or inheritance tax is known as Capital Acquisitions Tax [CAT] and is primarily payable by the person receiving the gift/inheritance.

When do I need to pay CAT?

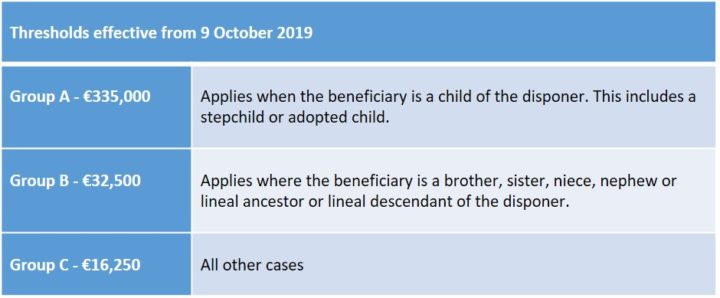

CAT is payable if a gift/inheritance is valued over a certain limit and various thresholds apply, depending on the relationship between you (the beneficiary) and the giver (the disponer).

A gift/inheritance may include –

• cash

• jewellery or a car

• house or lands

• stocks and shares

• the use of a property for free

• an interest free loan

What exemptions or reliefs are available?

There are a number of exemptions and reliefs depending on the type of gift/inheritance.

Different thresholds apply based on the relationship between the disponer and the beneficiary as follows –

CAT would not arise where :

• a gift, valued at €3,000 or less, is received from any one person in any one year (known as a Small Gift Exemption)

• a gift/inheritance is received from your spouse or civil partner

• normal and reasonable payments received from family members for support, maintenance, education or by a dependent relative for support or maintenance.

• the gift/inheritance is below the group threshold (when the value is added to previous gifts/inheritances received with the same threshold)

There are other specific reliefs that may be available (such as Dwelling House Exemption, Business Relief, Agricultural relief) and specific advice should be obtained.

What is the current rate of CAT?

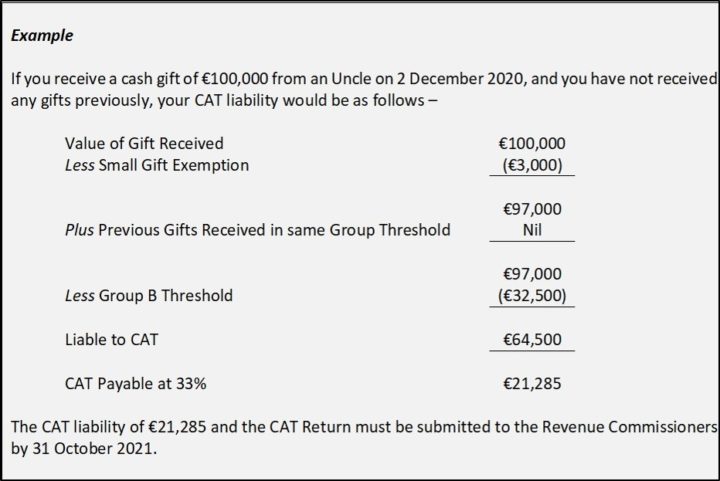

CAT is charged at 33% on the value of the gifts/inheritance that exceeds the relevant group threshold.

What are my obligations?

You are obliged to file a CAT Return (IT38), where the value of the gift/inheritance when combined with gifts/inheritances previously received, is 80% or more of the relevant group threshold.

If you receive a gift/inheritance between –

• 1 January and 31 August – you must Pay & File by 31 October * of that year

• 1 September and 31 December – you must Pay & File by 31 October * of the following year

*Extensions may be available if you Pay & File using Revenue’s Online Service [ROS].

If you are still unsure of your CAT obligations, get in touch with one of our tax specialists today on 1800 54 54 22.