Tax Credit Entitlements

by Eimear Larrissey, Tax Team Contracting PLUS

What are Tax Credits

In simple terms, Tax Credits reduce the amount of tax you pay.

Everyone is entitled to Personal Tax Credits – the annual credit for a standard individual is currently €1,650. If you’re self-employed (in receipt of trading and professional income) or a proprietary director, you may be entitled to the Earned Income Tax Credit.

The Earned Income Tax Credit

The Earned Income Credit for self-employed individuals (which includes Professional Contractors) was first introduced in January 2016 to assist in bridging the gap between the taxation of self-employed individuals and employees in Ireland. The Earned Income Credit has increased from an annual tax credit in 2016 of €550 to €1,650 in 2021.

How to apply for your Tax Credit?

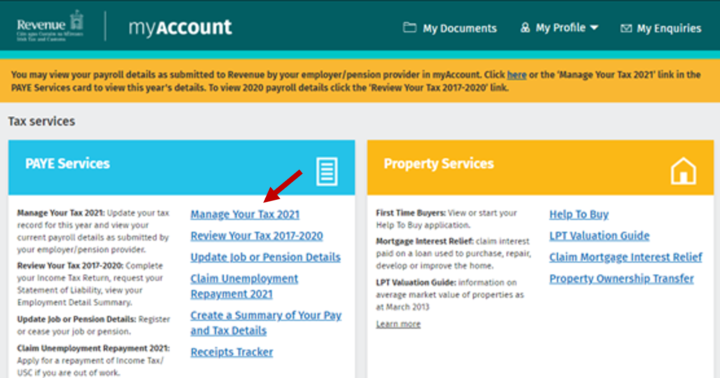

You can check and add credits through your online ROS account.

To check the credits you currently have assigned, login and head to the “PAYE services” section. Click through to “Manage your tax 2021” and “View my tax credit certificate”.

Once your Tax Credit Certificate loads, you’ll be able to check the Tax Credit section which details the credits currently assigned.

If you have any questions on your own tax credits, don’t hesitate to contact your Dedicated Account Manager here in Contracting PLUS – they will be happy to help you. Their direct contact details (phone and email) are listed in your MyContracting PLUS online portal.