Budget 2018 Guide

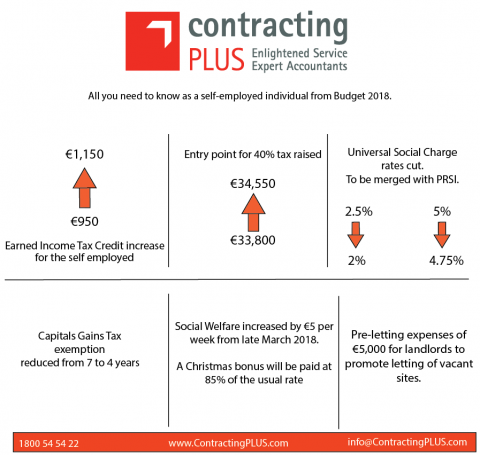

There has been plenty of discussion surrounding yesterday’s Budget delivered by Paschal Donohue. Follow the link below for our full review on the new implementations for 2018. Budget 2018 has continued with the Governments promise to ease the taxation burden for self-employed individuals. This has been done by increasing the Earned Income Credit by 200 to 1,150. This coupled with the increase in the standard rate bands and reduction in the rate of USC, is a positive step in the right direction.

Contracting PLUS, in conjunction with the Professional Contractors Services Organisation (PCSO), continue to lobby the government to improve the tax position for self-employed individuals and we would be hopeful that further improvements will be announced in the forth-coming Finance Bill.

Contracting PLUS Budget 2018 Summary – https://www.contractingplus.com/docs/BUDGET 2018 – Summary Guide.pdf